Price plus tax calculator

Sales Tax Calculator. Sales tax Formula Final Price Final price including tax before tax price 1 tax rate 100 or Final price including tax before tax price 1 tax rate tax expressed as a decimal 2 You buy a product for 1075 dollars with tax included.

Sales Tax Calculator

Tax 940 0075.

. In general retail sales tax rates are lower than VAT rates 4-10 percent as opposed to 14-25. Tax 705 tax value rouded to 2 decimals Add tax to the before tax price to get the final price. Total price 54500 - listed price 500 45 Then divide the difference.

A combination of high property tax rates and high home values in. Sales tax and VAT are similar in that rates are often expressed as a percentage of the price. Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage.

Price plus tax calculator Sabtu 03 September 2022 Edit. You can easily calculate the discounted. Heres how to calculate sales tax by hand.

Subtract the listed item price from the total price you paid. To easily divide by 100 just move the decimal point two spaces to the left. You know that the tax rate at your state is 75.

Our percent discount and tax calculator lets you quickly determine the final price of a product after a discount. 14 rows The following table provides the GST and HST provincial rates since July 1 2010. Tax 2400 0075.

Check out our mortgage calculator. Tax 180 tax value. Also known as the SALT deduction it allows taxpayers to deduct up to 10000 of any state and local property taxes plus either their state and local income taxes or sales taxes.

The rate you will charge depends on different factors see. To easily divide by 100 just move the decimal point two spaces to the left. Type of supply learn.

Looking to calculate your potential monthly mortgage payment. This tool will calculate the net selling price and tax amount from the gross selling price and required sales tax value. Now find the tax value by multiplying tax rate by the before tax price.

Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. This tool will calculate the net selling price and tax amount from the gross selling price and required sales tax value added tax VAT or goods services tax GST percentage rate. This tool will calculate the net selling price and tax amount from the gross selling price and required sales tax value.

75100 0075 tax rate as a decimal. Firstly divide the tax rate by 100. Now find the tax value by multiplying.

Now find the tax value by multiplying tax rate by the before tax price. The final price including tax 940 705 10105. Percent Discount and Tax Calculator.

Price plus tax calculator Sabtu 03 September 2022 Edit. Sales tax is calculated by multiplying the.

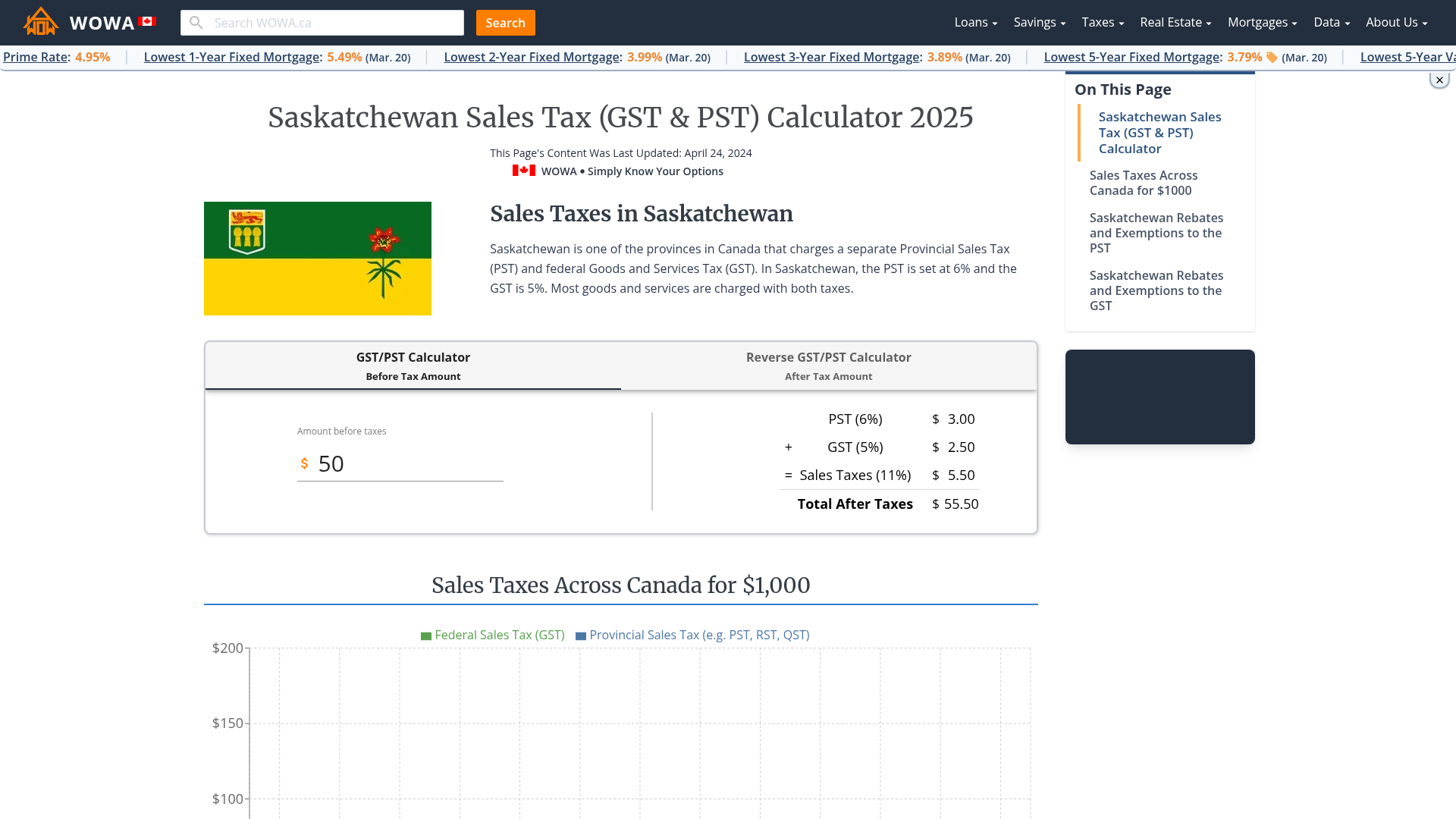

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

Manitoba Gst Calculator Gstcalculator Ca

Ontario Income Tax Calculator Wowa Ca

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Cannabis Taxes At Your Dispensary

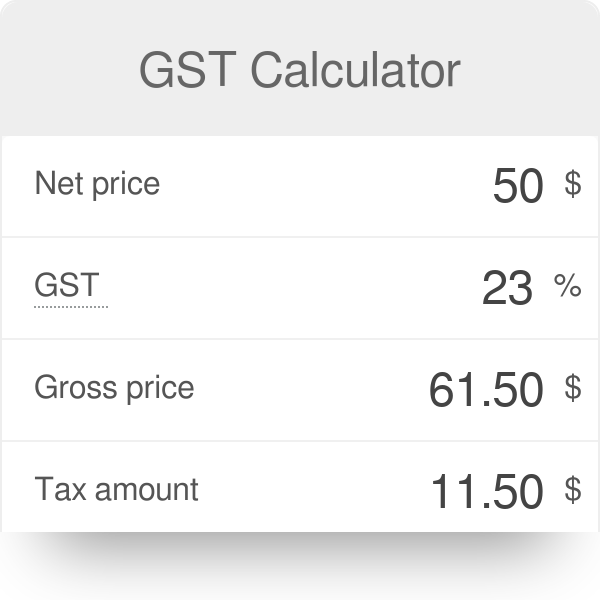

Sales Tax Calculator

How To Calculate Sales Tax In Excel

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Sales Tax Calculator

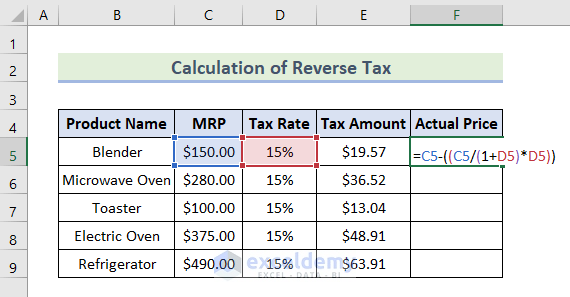

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

How To Calculate Sales Tax In Excel

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Gst Calculator How To Calculate Gst

How To Calculate Sales Tax In Excel

Reverse Sales Tax Calculator